Your competitors already have the backlinks you need. Competitor link analysis reveals exactly which sites link to them, why those links exist, and how you can earn similar or better placements. This strategic approach transforms guesswork into a data-driven acquisition roadmap.

Understanding where competitors earn their authority gives you a proven blueprint. Instead of building links blindly, you target sources already receptive to your industry.

This guide covers the complete framework: analysis methodology, quality evaluation, gap identification, replication strategies, and sustainable acquisition processes that drive measurable ranking improvements.

What Is Competitor Link Analysis?

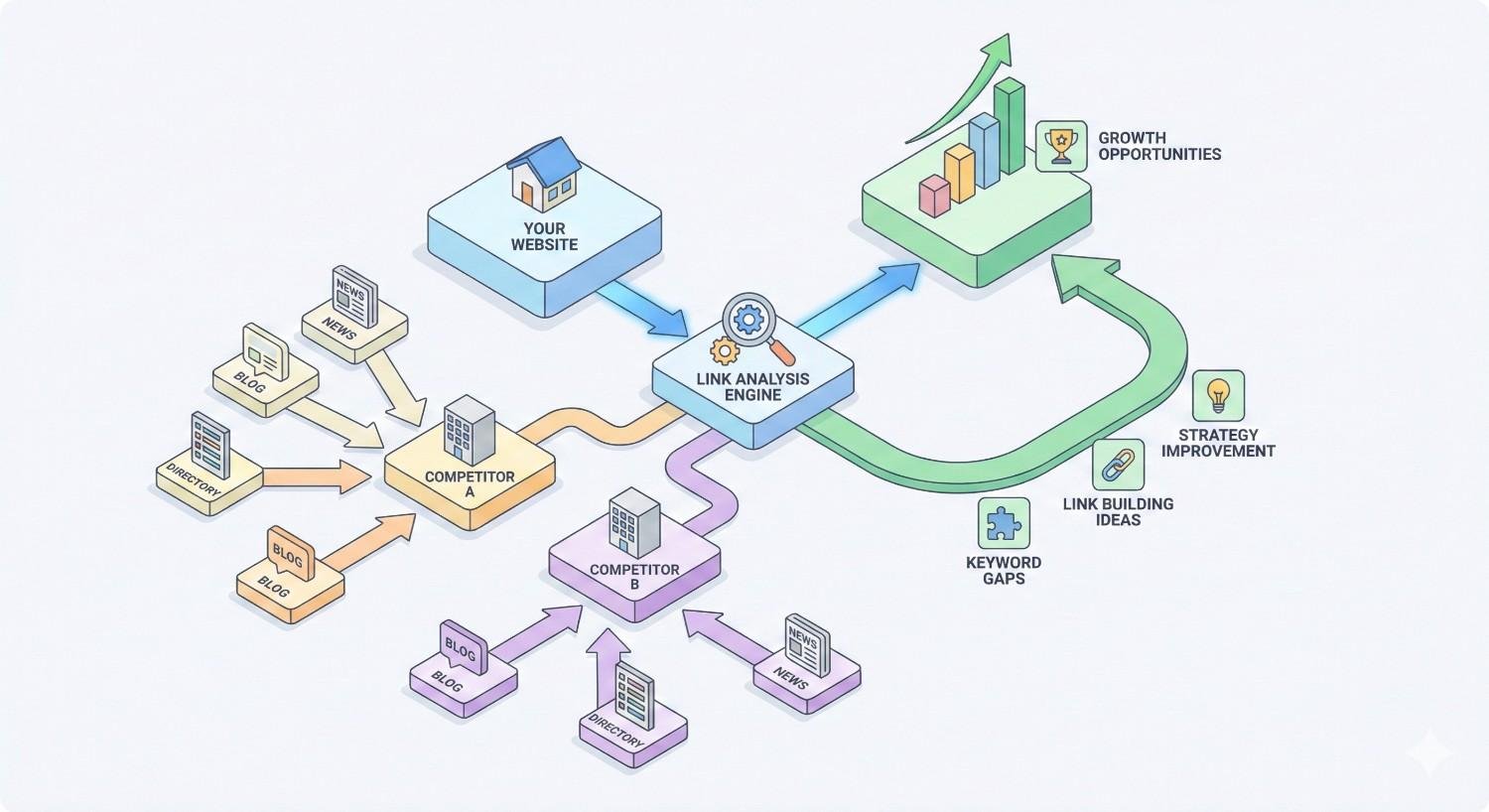

Competitor link analysis is the systematic process of examining the backlink profiles of websites ranking for your target keywords. You identify which domains link to competitors, evaluate link quality, and uncover acquisition opportunities applicable to your own site.

This practice goes beyond simple curiosity. It provides actionable intelligence about what search engines reward in your specific niche. When multiple competitors earn links from the same sources, those sources become high-priority targets for your outreach.

The analysis reveals patterns invisible without data. You discover which content formats attract links, which relationship-building approaches work, and which link types correlate with strong rankings in your market.

Core Components of Link Analysis

Effective competitor link analysis examines several interconnected elements. Each component contributes to a complete picture of competitive backlink landscapes.

Referring Domain Inventory catalogs every unique website linking to competitors. Raw link counts matter less than the diversity and quality of referring domains. A competitor with 500 links from 50 domains has a weaker profile than one with 300 links from 200 domains.

Link Attribute Assessment examines whether links are dofollow or nofollow, their placement within content, and surrounding context. Editorial links embedded in relevant articles carry more weight than footer links or sidebar widgets.

Anchor Text Analysis reveals how other sites describe competitors when linking. Natural profiles show varied anchor text including branded terms, naked URLs, and topically relevant phrases. Over-optimized profiles with exact-match anchors signal potential manipulation.

Temporal Patterns track when competitors acquired links. Sudden spikes may indicate campaigns worth investigating. Steady growth suggests sustainable strategies you can model.

Content Association identifies which specific pages attract links. Competitors may have particular resources, tools, or research pieces earning disproportionate attention. These content types become templates for your own link-worthy assets.

Why Competitor Backlinks Matter for SEO Performance

Backlinks remain among the strongest ranking signals in search algorithms. Google’s documentation confirms that links help determine page importance and relevance.

Competitor backlink analysis matters because it shows what actually works in your specific market. Generic link building advice cannot account for industry-specific dynamics. Analyzing competitors reveals the exact link types, sources, and quantities correlating with top rankings for your keywords.

The competitive gap directly impacts your ranking potential. If competitors average 150 referring domains and you have 40, closing that gap becomes a measurable objective. You know the target and can track progress.

Beyond quantity, competitor analysis exposes quality benchmarks. You learn which authoritative sites in your niche actively link out, making them realistic outreach targets rather than aspirational wishes.

How Competitor Link Analysis Works: The Strategic Framework

Successful competitor link analysis follows a structured framework. Random exploration wastes time. Strategic methodology produces actionable insights efficiently.

The framework moves from broad identification through detailed evaluation to prioritized opportunity lists. Each phase builds on previous findings, creating a comprehensive competitive intelligence picture.

Identifying Your True SEO Competitors

Your SEO competitors may differ from your business competitors. A local accounting firm competes for clients with other local firms. But for keywords like “small business tax deductions,” they compete with national publications, software companies, and financial advisors.

SERP-based identification provides the most accurate competitor list. Search your target keywords and note which domains consistently appear. These are your true SEO competitors regardless of business model overlap.

Focus on competitors ranking for multiple keywords in your target set. A site ranking for one keyword may have achieved that through factors irrelevant to your broader strategy. Sites ranking consistently across your keyword portfolio demonstrate replicable authority.

Consider competitor types strategically. Direct business competitors offer the most relevant link opportunities since their backlink sources likely accept similar content. Informational competitors like publications may have links you cannot replicate but reveal industry-specific sources worth pursuing.

Limit your initial analysis to 5-7 competitors. More creates data overload without proportional insight gains. You can expand later after processing initial findings.

Mapping Competitor Backlink Profiles

Profile mapping creates a structured view of each competitor’s link landscape. This goes beyond raw lists to categorized, analyzable data.

Start by exporting complete backlink data for each competitor. Most analysis tools provide CSV exports including referring domain, target URL, anchor text, domain metrics, and link attributes.

Organize data by referring domain rather than individual links. Multiple links from one domain typically count as a single relationship in algorithmic terms. Domain-level analysis reveals true profile breadth.

Create comparison matrices showing which competitors share referring domains. Sites linking to multiple competitors represent proven opportunities since they clearly link to content in your space.

Map link distribution across competitor pages. Identify which content types attract links. Homepage links suggest brand authority. Deep links to specific resources indicate content-driven acquisition strategies you can model.

Evaluating Link Quality vs. Link Quantity

Link quality dramatically outweighs quantity in modern SEO. One link from an authoritative, relevant source provides more ranking value than dozens of low-quality links.

Relevance serves as the primary quality indicator. A link from an industry publication carries more weight than a link from a general directory, even if the directory has higher domain metrics. Search engines understand topical relationships.

Authority metrics like Domain Rating or Domain Authority provide useful proxies but require context. A DR 40 site in a specialized niche may be the most authoritative source in that space. A DR 80 general site linking to everything dilutes its value.

Traffic indicators suggest real-world authority. Sites with actual visitors represent genuine resources people use. Links from zero-traffic sites, regardless of metrics, often indicate link schemes or abandoned properties.

Editorial standards matter significantly. Links from sites with clear editorial processes, original content, and engaged audiences carry more trust than links from sites accepting any submission.

Evaluate competitor links through these lenses. High-quality links worth replicating share characteristics: topical relevance, genuine authority, real traffic, and editorial legitimacy.

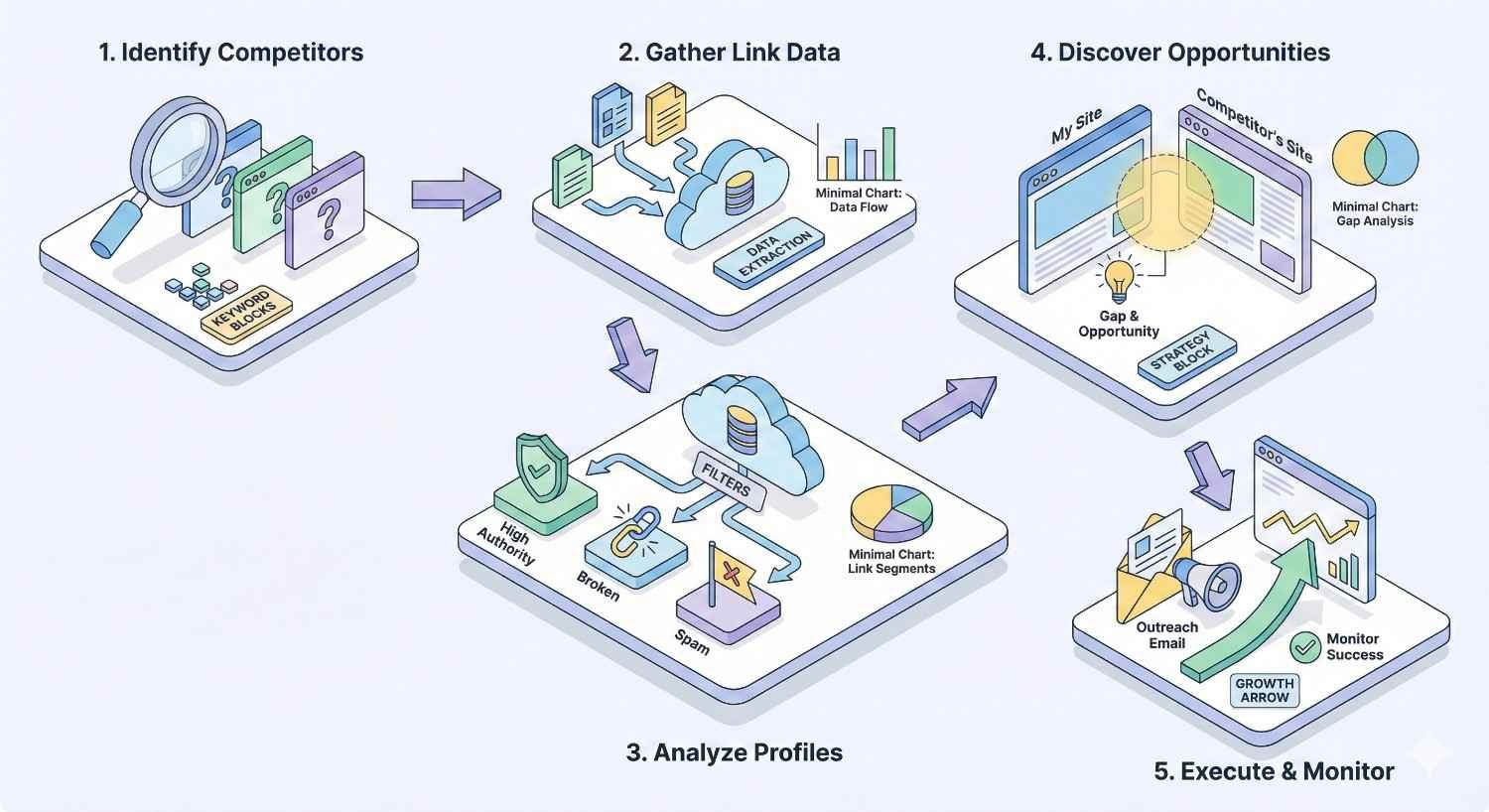

Step-by-Step Process for Competitor Link Analysis

Systematic process execution transforms competitor link analysis from overwhelming data exploration into manageable, actionable workflow. Follow these steps sequentially for optimal results.

Step 1 – Select Competitors and Gather Backlink Data

Begin with competitor selection based on SERP analysis. Search 10-15 target keywords and record which domains appear most frequently in top positions. Prioritize competitors ranking for high-value commercial keywords over informational terms.

Verify competitors represent achievable targets. Analyzing Wikipedia or major news publications wastes effort since their link profiles reflect resources and authority you cannot match. Focus on competitors within realistic reach of your current authority level.

Choosing the Right Analysis Tools

Several platforms provide comprehensive backlink data. Selection depends on budget, data freshness requirements, and specific feature needs.

Ahrefs offers one of the largest backlink indexes with frequent crawl updates. Its Site Explorer provides detailed referring domain data, anchor text analysis, and historical link tracking. The Link Intersect tool specifically identifies sites linking to multiple competitors.

Semrush combines backlink analysis with broader competitive intelligence. Its Backlink Gap tool compares your profile against competitors directly, highlighting opportunities. Integration with other Semrush tools supports comprehensive SEO workflows.

Moz Link Explorer provides Domain Authority metrics widely used in the industry. Its Spam Score helps identify potentially harmful links to avoid replicating.

For budget-conscious analysis, Ubersuggest offers basic backlink data at lower cost. Data depth and freshness lag premium tools but suffice for initial exploration.

Choose tools based on your specific needs. Most offer trial periods allowing evaluation before commitment.

Exporting and Organizing Backlink Data

Export referring domain reports for each competitor. Include all available metrics: domain rating, traffic estimates, link count, anchor text, target URL, and link attributes.

Create a master spreadsheet consolidating competitor data. Use separate tabs for each competitor initially, then create comparison views.

Standardize data formats across exports. Different tools use varying metric names and scales. Normalize data for accurate comparison.

Remove obvious spam and irrelevant domains during initial organization. Links from foreign-language sites unrelated to your market, obvious link farms, or defunct domains clutter analysis without value.

Tag domains by type during organization: publications, blogs, directories, forums, educational institutions, government sites. This categorization supports later prioritization.

Step 2 – Analyze Link Metrics and Quality Indicators

With organized data, systematic quality analysis identifies which competitor links represent genuine opportunities versus noise.

Domain Authority and Trust Metrics

Domain metrics provide starting points for quality assessment. Higher-authority domains generally pass more ranking value through links.

Examine metric distributions across competitor profiles. If most competitor links come from DR 30-50 sites, targeting only DR 70+ sites misallocates effort. Match your targeting to proven successful ranges.

Consider metric trends alongside absolute values. A site with DR 35 growing steadily may offer more value than a stagnant DR 50 site. Growth indicates active investment and engagement.

Trust metrics like Moz Spam Score or Ahrefs’ similar indicators flag potentially problematic sources. High spam scores suggest link schemes or compromised sites. Avoid replicating links from flagged domains.

Cross-reference metrics across tools when possible. Significant discrepancies between Ahrefs and Moz assessments warrant closer manual review.

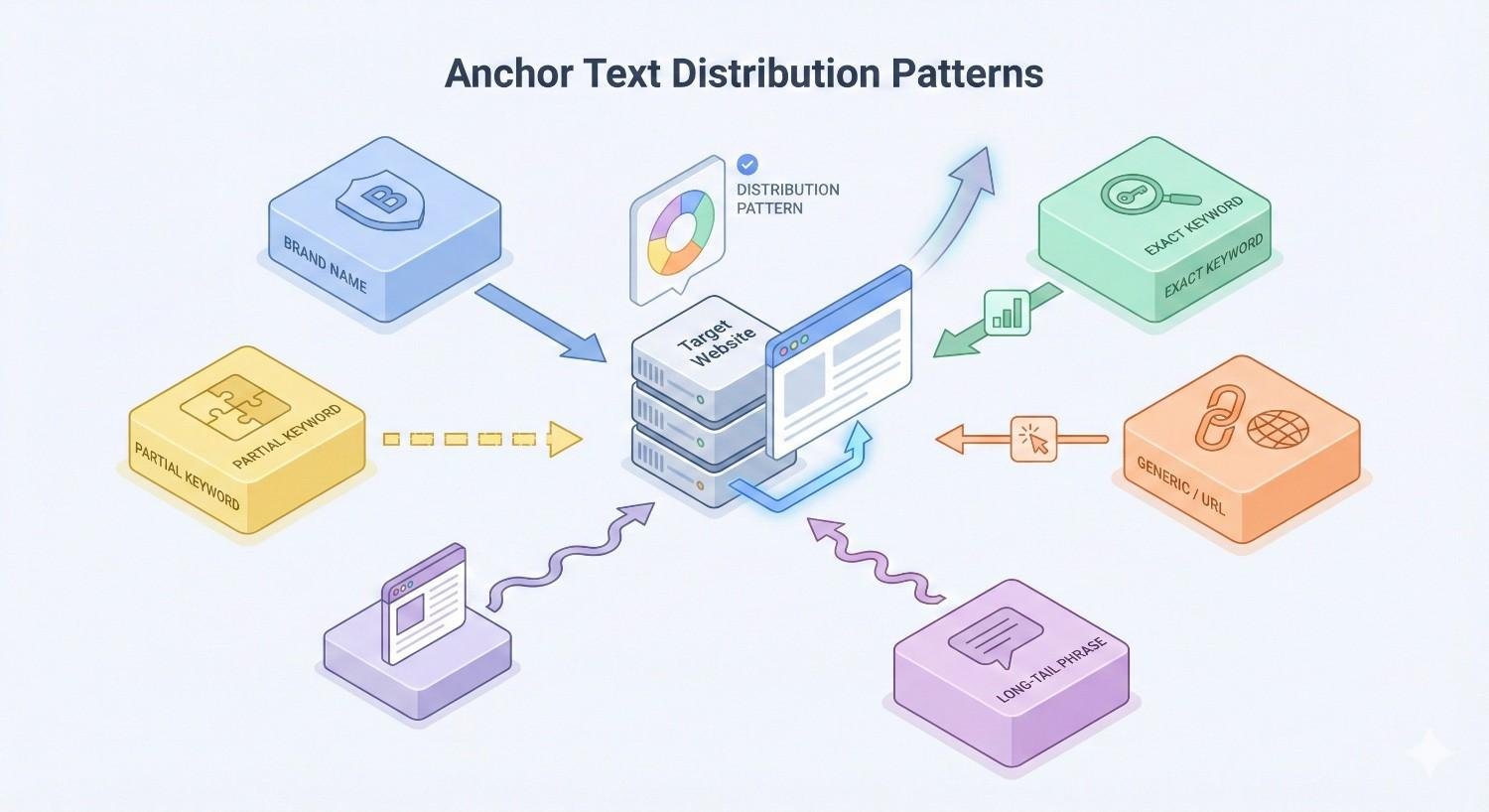

Anchor Text Distribution Patterns

Healthy anchor text profiles show natural variation. Analyze competitor distributions to understand what search engines accept in your niche.

Branded anchors using company names typically comprise 30-50% of natural profiles. Lower branded percentages may indicate manipulation or lack of brand recognition.

Naked URLs and generic anchors like “click here” or “this article” appear naturally when people link without optimization intent. Their presence signals organic acquisition.

Topical anchors using relevant keywords should appear but not dominate. Exact-match keyword anchors exceeding 5-10% of profiles often indicate optimization attempts that may trigger algorithmic scrutiny.

Compare your current anchor distribution against competitors. Significant deviations in either direction suggest adjustment needs. If competitors show 40% branded anchors and you show 10%, brand-building efforts may be warranted.

Link Context and Relevance Signals

Context determines link value more than metrics alone. A link embedded in relevant editorial content within a topically aligned site carries maximum weight.

Examine where competitor links appear on pages. Links within main content bodies indicate editorial endorsement. Sidebar, footer, or author bio links suggest different relationship types with varying value.

Assess surrounding content relevance. A link to a marketing agency from an article about marketing strategies makes contextual sense. The same link from an article about cooking recipes suggests paid placement or irrelevant acquisition.

Review linking page quality independently. Well-written, comprehensive content on the linking page suggests editorial standards that enhance link value. Thin content pages provide less meaningful endorsement.

Note content formats attracting links. If competitors earn links primarily through original research, guest posts, or tool pages, these formats become priorities for your content strategy.

Step 3 – Identify Link Gap Opportunities

Gap analysis reveals specific opportunities where competitors have links you lack. These represent the most actionable findings from competitive research.

Finding Sites Linking to Multiple Competitors

Sites linking to multiple competitors demonstrate clear willingness to link within your industry. They represent the highest-probability outreach targets.

Use link intersection tools to identify these overlapping sources. Ahrefs Link Intersect, Semrush Backlink Gap, and similar features automate this comparison.

Prioritize sites linking to 3+ competitors. These sources actively cover your industry and likely seek additional relevant content to reference.

Examine why these sites link to competitors. Understanding the content or relationship triggering links informs your approach. If they link to competitor research studies, creating your own research becomes the path to earning similar links.

Create a dedicated list of intersection domains ranked by authority and relevance. This becomes your primary outreach target list.

Spotting High-Value Link Sources

Beyond intersection analysis, identify high-value sources linking to individual competitors that represent significant opportunities.

Look for authoritative industry publications linking to any competitor. Even if they link to only one competitor currently, they clearly cover your space and may link to you with appropriate content.

Identify resource pages and link roundups in your niche. These curated lists actively seek quality resources to include. Competitor presence indicates your potential inclusion.

Note educational and government links. These high-authority domains rarely link commercially but may reference industry resources, research, or tools. Competitor links from .edu or .gov domains warrant investigation into replication potential.

Flag competitor links from sites where you have existing relationships. Contacts at publications, partners, or industry connections may provide easier paths to similar links.

Step 4 – Categorize and Prioritize Link Opportunities

Raw opportunity lists require organization for efficient execution. Categorization and prioritization transform data into actionable outreach plans.

Link Type Classification (Editorial, Resource, Directory, etc.)

Different link types require different acquisition approaches. Classify opportunities by type to organize outreach strategies.

Editorial links appear within article content as natural references. Earning these requires creating content worth referencing or building relationships with writers and editors. They carry highest value but require most effort.

Guest post links come from contributed content on external sites. Many publications accept guest contributions, providing link opportunities through content creation. Quality varies significantly by publication standards.

Resource page links appear on curated lists of industry resources. Acquisition requires having a resource worth listing and identifying appropriate pages. Outreach is straightforward once you have qualifying content.

Directory links come from industry or local business directories. Value varies dramatically. Legitimate industry directories provide relevant links. Generic directories offer minimal value and may cause harm.

Forum and community links appear in discussion contexts. These typically carry nofollow attributes but drive referral traffic and brand awareness. Acquisition requires genuine community participation.

Partnership and sponsorship links result from business relationships. These require investment beyond content creation but provide contextually relevant placements.

Classify each opportunity by type. This organization enables batch processing of similar outreach approaches.

Creating a Prioritized Outreach List

Prioritization ensures effort focuses on highest-value opportunities first. Not all links deserve equal pursuit.

Tier 1 opportunities combine high authority, strong relevance, and clear acquisition paths. Sites linking to multiple competitors with obvious content gaps you can fill belong here. Pursue these immediately.

Tier 2 opportunities offer good authority and relevance but require more effort. Single-competitor links from authoritative sources or intersection links requiring significant content creation fit this tier.

Tier 3 opportunities provide incremental value. Lower-authority sites, directories, and forums offer links worth having but not worth prioritizing over higher tiers.

Create a tracking spreadsheet with columns for: domain, authority metrics, link type, competitor(s) linking, acquisition approach, status, and follow-up dates.

Set realistic targets. Pursuing 50 Tier 1 opportunities simultaneously dilutes effort. Focus on 10-15 active pursuits with others queued for future attention.

Link Replication Strategies: From Analysis to Acquisition

Analysis without action produces no results. Replication strategies transform competitive intelligence into actual link acquisition.

Different link types require different approaches. Match your strategy to the opportunity type for optimal success rates.

Replicating Editorial Links and Guest Posts

Editorial links require content that earns editorial attention. You cannot simply request these links. You must create something worth linking to.

Content gap analysis identifies topics competitors cover that attract links but you have not addressed. Creating superior content on these topics positions you for similar link acquisition.

Original research and data consistently earn editorial links. Journalists and bloggers need sources to cite. Producing original statistics, surveys, or analysis makes you a citable source.

Expert commentary opportunities arise when publications seek industry perspectives. Monitor journalist request platforms like HARO, Qwoted, or SourceBottle. Responding with genuine expertise earns editorial mentions and links.

Guest posting requires identifying publications accepting contributions and pitching relevant topics. Study competitor guest posts to understand what publications accept. Pitch unique angles rather than rehashing existing content.

Personalize outreach for editorial opportunities. Generic templates fail. Reference specific articles, demonstrate familiarity with the publication, and explain why your content serves their audience.

Securing Resource Page and Directory Listings

Resource pages and directories offer more straightforward acquisition paths. You need qualifying content and appropriate outreach.

Resource page identification starts with competitor analysis. Note which resource pages link to competitors. Search operators like “keyword + resources” or “keyword + useful links” find additional opportunities.

Qualification requirements vary by page. Some resource pages list any relevant site. Others require specific content types, tools, or credentials. Review existing listings to understand inclusion criteria.

Outreach for resource pages should be concise and specific. Identify the page, explain what you offer, and request consideration. Provide the specific URL you want listed and brief description of its value.

Directory selection requires quality assessment. Legitimate industry directories maintained by associations or established publications provide value. Generic directories accepting any submission offer minimal benefit and potential risk.

Prioritize directories where competitors appear. Their presence validates directory legitimacy and relevance.

Earning Links Through Content Assets

Certain content types consistently attract links across industries. Creating these assets provides ongoing link acquisition opportunities.

Comprehensive guides covering topics thoroughly become reference resources others link to when discussing those topics. This guide exemplifies the format. Depth and completeness differentiate link-worthy guides from ordinary blog posts.

Original tools and calculators solve problems for users who then share and link to them. Competitors with tool-based links reveal demand for similar resources in your space.

Data visualizations and infographics present information in shareable formats. Visual content earns links when others embed or reference the visuals.

Research reports and surveys provide citable data. Annual industry reports become recurring link sources as others reference your findings.

Templates and frameworks offer practical value users appreciate and share. Downloadable resources addressing common needs attract links from sites recommending solutions.

Analyze which content types earn links for competitors. Invest in creating superior versions of proven formats rather than experimenting with unvalidated approaches.

Building Relationships with Link Sources

Sustainable link acquisition depends on relationships, not transactions. Building genuine connections with link sources creates ongoing opportunities.

Industry engagement through conferences, webinars, and communities introduces you to potential link sources. People link to people they know and trust.

Social media interaction with journalists, bloggers, and industry voices builds familiarity before you need anything. Consistent engagement makes outreach feel like conversation rather than cold contact.

Collaborative content like expert roundups, interviews, or joint research creates mutual benefit. Contributors naturally share and link to content featuring them.

Providing value first establishes reciprocity. Sharing others’ content, offering helpful feedback, or making introductions builds goodwill that facilitates future link requests.

Long-term relationship building produces better results than transactional outreach. Invest in connections that compound over time.

Common Link Patterns Worth Replicating

Competitor analysis reveals patterns beyond individual opportunities. Recognizing these patterns enables systematic replication rather than one-off pursuits.

Industry-Specific Link Patterns

Every industry has characteristic link patterns reflecting its information ecosystem. Understanding your industry’s patterns focuses effort appropriately.

B2B industries often show patterns around thought leadership content, industry publications, and professional associations. Links come from trade publications, conference sites, and partner ecosystems.

E-commerce patterns frequently involve product reviews, comparison sites, and shopping guides. Affiliate relationships and editorial product coverage drive many links.

Local businesses see patterns around local directories, community sites, news coverage, and chamber of commerce listings. Geographic relevance dominates over topical authority.

SaaS and technology patterns emphasize integration partnerships, review platforms like G2 or Capterra, and technical documentation references.

Professional services patterns include industry associations, certification bodies, educational institutions, and case study features.

Identify which patterns dominate your competitive landscape. Align your acquisition strategy with proven industry patterns rather than generic approaches.

Content-Type Link Patterns (Guides, Tools, Research)

Certain content formats consistently attract links across industries. Competitor analysis reveals which formats work in your specific market.

Ultimate guides and comprehensive resources earn links when they become definitive references. If competitors have guide-based links, creating superior guides opens similar opportunities.

Free tools attract links from sites recommending solutions. Calculator tools, assessment tools, and utility applications earn ongoing links as users discover and share them.

Original research including surveys, data analysis, and industry reports provides citable sources. Publications need data to reference. Being the source earns links.

Case studies demonstrating results attract links from sites discussing solutions. Detailed outcome documentation serves as evidence others reference.

Templates and checklists earn links from sites helping audiences accomplish tasks. Practical resources get recommended and linked.

Note which content types dominate competitor link profiles. Invest in creating those formats rather than formats with no proven link-earning track record in your space.

Seasonal and Trending Link Opportunities

Some link opportunities follow predictable timing patterns. Recognizing these patterns enables proactive positioning.

Annual roundups and predictions appear at year-end and year-start. Publications seeking expert input for these pieces provide link opportunities for prepared contributors.

Industry events generate coverage opportunities. Conference sponsorships, speaking engagements, and event-related content earn links during event seasons.

Seasonal content relevant to holidays, fiscal periods, or industry cycles attracts links during appropriate windows. Tax-related content earns links in tax season. Back-to-school content peaks in late summer.

Trending topics create temporary link opportunities. Rapid response to industry news or emerging trends can earn links from publications covering developments.

Monitor competitor link acquisition timing. Patterns in when they earn links reveal seasonal opportunities you can anticipate and prepare for.

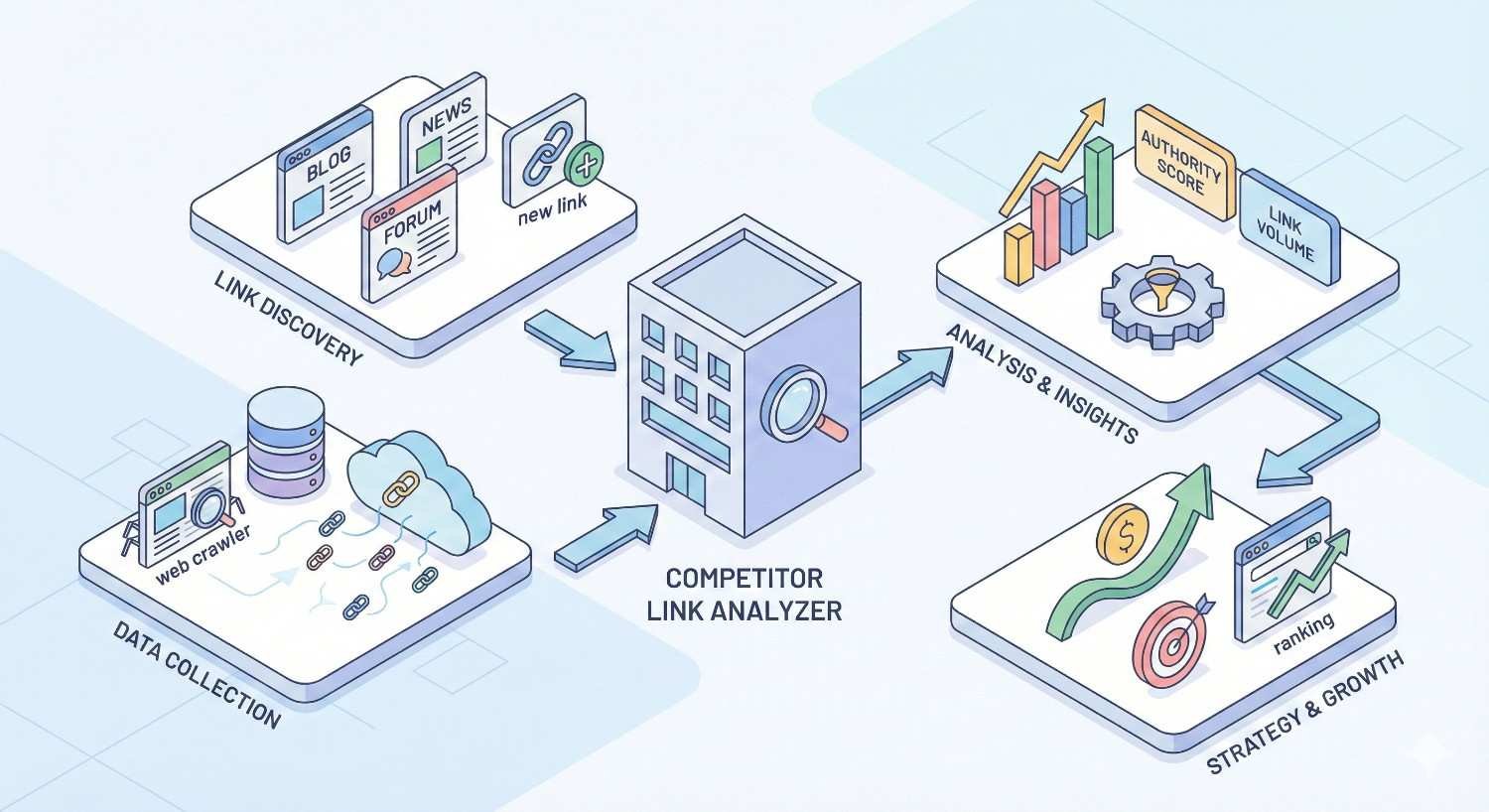

Tools and Technology for Competitor Link Analysis

Effective competitor link analysis requires appropriate tools. Manual analysis cannot scale to the data volumes involved.

Comprehensive Backlink Analysis Platforms

Full-featured backlink platforms provide the data foundation for competitor analysis.

Ahrefs maintains one of the largest backlink indexes with over 35 trillion links tracked. Site Explorer provides detailed competitor backlink data. The Link Intersect feature specifically supports competitive gap analysis.

Semrush offers integrated competitive analysis combining backlinks with keyword and content intelligence. The Backlink Gap tool directly compares profiles across competitors.

Majestic provides unique metrics including Trust Flow and Citation Flow that offer alternative quality perspectives. Its historical index enables analysis of link acquisition patterns over time.

Moz Pro includes Link Explorer with Domain Authority metrics widely referenced in the industry. Spam Score helps identify potentially harmful links.

Most professionals use multiple tools since each has unique index coverage and metrics. Cross-referencing findings improves accuracy.

Link Intersection and Gap Analysis Tools

Specialized features within broader platforms specifically support competitive gap identification.

Ahrefs Link Intersect compares up to 10 domains simultaneously, identifying sites linking to competitors but not you. Filtering options narrow results by authority, traffic, and link attributes.

Semrush Backlink Gap provides similar functionality with integration into Semrush’s broader competitive intelligence suite. Visual comparison charts highlight opportunity magnitude.

Moz Link Intersect offers gap analysis with Moz-specific metrics. Integration with other Moz tools supports comprehensive competitive workflows.

These tools automate what would otherwise require manual spreadsheet comparison across thousands of domains. Time savings justify tool investment for serious link building efforts.

Workflow Automation and Tracking Systems

Managing link acquisition at scale requires systems beyond analysis tools.

Outreach platforms like Pitchbox, BuzzStream, or Hunter.io manage contact finding, email sequences, and response tracking. They prevent opportunities from falling through cracks and enable systematic follow-up.

CRM systems adapted for link building track relationship status, communication history, and opportunity pipeline. Treating link acquisition like sales improves conversion rates.

Project management tools like Asana, Monday, or Trello organize link building workflows. Task assignment, deadline tracking, and progress visibility keep campaigns moving.

Spreadsheet systems remain viable for smaller operations. Google Sheets with proper organization handles moderate link building volumes without specialized tool investment.

Choose systems matching your scale and resources. Over-engineering small campaigns wastes time. Under-engineering large campaigns loses opportunities.

Realistic Timelines for Link Replication Success

Link building produces results over months, not days. Setting realistic expectations prevents premature strategy abandonment.

Analysis Phase: 1-2 Weeks

Thorough competitor analysis requires dedicated time. Rushing produces incomplete insights and missed opportunities.

Week 1 focuses on data gathering: competitor identification, backlink exports, and initial organization. Allow time for tool learning if using new platforms.

Week 2 covers analysis and prioritization: quality evaluation, gap identification, and opportunity list creation. This phase requires judgment that cannot be rushed.

Attempting to compress analysis into days produces superficial findings. The investment in thorough analysis pays dividends throughout subsequent acquisition efforts.

Outreach and Acquisition: 3-6 Months

Link acquisition happens gradually. Even excellent outreach produces responses over weeks, not hours.

Month 1 initiates outreach to highest-priority opportunities. Expect low response rates initially as you refine messaging and targeting.

Months 2-3 see initial link placements from early outreach while continuing new contact. Response patterns inform approach adjustments.

Months 4-6 produce compounding results as relationship building bears fruit and refined approaches improve conversion rates.

Typical outreach-to-link conversion rates range from 3-10% depending on approach quality and opportunity relevance. Plan contact volumes accordingly.

Impact on Rankings: 4-12 Months

Links influence rankings gradually as search engines discover, evaluate, and incorporate them into algorithms.

Months 1-3 after link acquisition typically show minimal ranking impact. Search engines crawl and index new links on varying schedules.

Months 4-6 begin showing measurable ranking improvements for targeted keywords. Impact correlates with link quality and competitive gap closure.

Months 6-12 demonstrate full impact as link equity distributes through your site and algorithmic assessments stabilize.

Patience is essential. Abandoning link building after three months because rankings have not moved ignores the timeline reality. Consistent effort over extended periods produces sustainable results.

Avoiding Common Competitor Link Analysis Mistakes

Competitor link analysis can mislead when executed poorly. Avoid these common mistakes that undermine strategy effectiveness.

Blindly Copying Low-Quality Links

Not all competitor links deserve replication. Some actively harm rankings.

Competitors may have acquired links through tactics now penalized. PBN links, paid links, or spam submissions appearing in competitor profiles represent risks, not opportunities.

Evaluate every potential replication target independently. Competitor presence does not validate link quality. Apply the same quality standards you would to any link opportunity.

Some competitors rank despite bad links, not because of them. Their authority from legitimate sources may overcome negative signals from poor links. Copying only the poor links without the legitimate ones produces net negative results.

Ignoring Link Context and Relevance

Metrics alone do not determine link value. Context matters enormously.

A high-authority link from an irrelevant site provides less value than a moderate-authority link from a highly relevant source. Topical alignment amplifies link impact.

Examine why competitors earned specific links. If the context does not apply to your business, the opportunity may not transfer. A competitor’s link from a partner announcement page cannot be replicated without a similar partnership.

Consider whether you can create appropriate context for desired links. Resource page links require having a resource worth listing. Editorial links require content worth referencing. Without appropriate context, outreach fails regardless of competitor success.

Overlooking Your Unique Link Opportunities

Competitor analysis reveals their opportunities, not yours exclusively. Your unique assets may enable links competitors cannot access.

Proprietary data you possess may attract links competitors cannot earn. Original research, customer insights, or operational data create unique link-earning potential.

Relationships you have may open doors closed to competitors. Industry connections, alumni networks, or partnership ecosystems provide exclusive opportunities.

Geographic or demographic positioning may enable locally-focused or community-specific links unavailable to differently-positioned competitors.

Brand story elements including founding narrative, mission alignment, or unique positioning may attract coverage competitors cannot replicate.

Balance competitor replication with unique opportunity development. The combination produces stronger results than either approach alone.

Integrating Link Analysis into Your Overall SEO Strategy

Link building does not exist in isolation. Integration with broader SEO strategy maximizes impact.

Aligning Link Building with Content Strategy

Content and links work together. Neither succeeds optimally without the other.

Content planning should incorporate link-earning potential. When competitor analysis reveals content types attracting links, prioritize creating those formats.

Link building should support content promotion. New content needs links to rank. Coordinating publication with outreach accelerates ranking impact.

Topic selection benefits from link opportunity awareness. Topics with proven link-earning potential in competitor profiles deserve prioritization over topics with no demonstrated link attraction.

Create feedback loops between content and link teams. Link builders identify content gaps competitors exploit. Content creators produce assets link builders can promote.

Coordinating Technical SEO and Link Acquisition

Technical foundation affects link value realization. Links to poorly-optimized pages underperform their potential.

Page speed and experience influence how search engines value links. Links to slow, poorly-designed pages may not produce expected ranking improvements.

Internal linking distributes link equity throughout your site. External links to one page benefit other pages through internal link architecture.

Indexation and crawlability determine whether search engines can discover and credit links. Technical barriers may prevent link value from registering.

Ensure technical SEO supports link building investment. Acquiring links to pages with technical problems wastes effort.

Measuring Link Impact on Organic Performance

Measurement validates strategy and guides optimization. Track link building impact systematically.

Link acquisition metrics track activity: outreach volume, response rates, links earned, and referring domain growth. These leading indicators show effort effectiveness.

Ranking metrics track keyword position changes for targeted terms. Correlate ranking improvements with link acquisition timing to validate impact.

Traffic metrics from Google Analytics or Search Console show organic visit growth. Links should ultimately drive traffic increases.

Conversion metrics connect link building to business outcomes. Traffic without conversions indicates targeting or landing page issues.

Establish baseline measurements before intensive link building. Without baselines, improvement attribution becomes impossible.

When to Conduct Competitor Link Analysis

Timing affects analysis value. Certain situations warrant fresh competitive analysis.

During Initial SEO Strategy Development

New SEO initiatives require competitive baseline understanding. Analysis at strategy inception informs realistic goal-setting and approach selection.

Competitive gap assessment reveals how much link building is needed. Understanding the gap between your current profile and ranking competitors sets appropriate expectations.

Opportunity identification at strategy start enables immediate action. Waiting months to analyze competitors delays acquisition that could begin immediately.

Benchmark establishment creates measurement foundations. Knowing competitor profiles at strategy start enables progress tracking against competitive standards.

When Launching New Content or Products

New offerings create new competitive contexts requiring fresh analysis.

New keyword targets may have different competitors than existing targets. Analyze competitors for new keywords specifically rather than assuming overlap.

Content launch support benefits from understanding what earns links for similar content. Competitor analysis for specific content types informs promotion strategy.

Product positioning in search requires understanding competitive link landscapes. New products may face different link-based competition than existing offerings.

Quarterly Competitive Monitoring

Competitive landscapes evolve. Regular monitoring catches changes requiring response.

New competitor emergence may shift competitive dynamics. Quarterly checks identify rising competitors worth analyzing.

Competitor link acquisition reveals their active strategies. Monitoring competitor profile growth shows what they are doing that you might replicate.

Opportunity refresh identifies new link sources entering your space. Publications launch, resource pages update, and new directories emerge. Regular monitoring catches these opportunities.

Set calendar reminders for quarterly competitive reviews. Consistent monitoring prevents competitive blind spots.

Building a Sustainable Link Acquisition Process

One-time link building campaigns produce temporary results. Sustainable processes create ongoing competitive advantage.

Creating Repeatable Outreach Workflows

Systematized outreach scales efficiently. Document processes for consistent execution.

Template libraries for different outreach types enable rapid personalization without starting from scratch. Create templates for resource page requests, guest post pitches, and editorial outreach.

Sequence automation through outreach platforms ensures consistent follow-up. Most links come from follow-up contacts, not initial outreach.

Response handling protocols standardize how to manage different reply types. Prepare approaches for positive responses, requests for more information, and rejections.

Quality control checkpoints prevent poor outreach from damaging reputation. Review samples regularly to maintain standards.

Document workflows so team members can execute consistently. Process documentation enables scaling beyond individual capacity.

Developing Link-Worthy Assets

Sustainable link building requires ongoing asset creation. Links flow to valuable content.

Content calendars should include link-earning content regularly. Plan research reports, tool development, and comprehensive guides as ongoing investments.

Asset maintenance keeps existing link-worthy content current. Outdated resources lose links. Regular updates preserve and grow link equity.

Format experimentation identifies new link-earning approaches. Test different content types to discover what resonates with your specific audience and link sources.

Promotion integration ensures new assets reach potential link sources. Creating great content without promotion limits link acquisition.

Treat link-worthy asset creation as ongoing investment rather than one-time project.

Tracking and Reporting Link Acquisition ROI

Demonstrating link building value justifies continued investment. Track and report ROI systematically.

Cost tracking captures all link building expenses: tools, content creation, outreach time, and any paid placements. Complete cost accounting enables accurate ROI calculation.

Value attribution connects links to ranking and traffic improvements. While direct attribution is imperfect, correlation analysis demonstrates impact.

Competitive benchmarking shows progress against competitors. Closing competitive gaps demonstrates strategic progress even before ranking improvements materialize.

Reporting cadences keep stakeholders informed. Monthly activity reports and quarterly impact assessments maintain visibility and support.

Build reporting into workflow from the start. Retroactive measurement is difficult. Proactive tracking enables ongoing demonstration of value.

How Our SEO Services Support Strategic Link Building

Effective competitor link analysis and replication requires expertise, tools, and sustained effort. Professional support accelerates results.

Comprehensive Competitor Analysis and Opportunity Identification

Our team conducts thorough competitive analysis using enterprise-grade tools and proven methodologies.

We identify your true SEO competitors through SERP analysis across your target keyword portfolio. Our analysis examines competitor backlink profiles comprehensively, evaluating quality, relevance, and replication potential.

Gap analysis reveals specific opportunities where competitors have links you lack. We prioritize opportunities by authority, relevance, and acquisition feasibility, creating actionable target lists.

Strategic Outreach and Relationship Building

Link acquisition requires skilled outreach and relationship development. Our team manages the complete acquisition process.

We craft personalized outreach for each opportunity type, from resource page requests to editorial pitches. Our established relationships with publications and industry sources accelerate placement timelines.

Systematic follow-up ensures opportunities are not lost. We track all outreach activity and optimize approaches based on response patterns.

Performance Tracking and Continuous Optimization

Measurement and optimization maximize link building ROI. We provide complete visibility into campaign performance.

Regular reporting shows link acquisition activity, profile growth, and ranking impact. We correlate link building efforts with organic performance improvements.

Continuous optimization refines targeting and outreach based on results. We adapt strategies as competitive landscapes evolve, maintaining your competitive position.

Conclusion

Competitor link analysis transforms link building from guesswork into strategic, data-driven acquisition. Understanding where competitors earn authority reveals proven opportunities applicable to your own site.

The process requires systematic execution: identifying true competitors, mapping their profiles, evaluating quality, finding gaps, and prioritizing opportunities. Replication strategies then convert analysis into actual links through appropriate outreach and relationship building.

We help businesses build sustainable organic growth through strategic link acquisition. Contact White Label SEO Service to discuss how competitor link analysis can accelerate your SEO results.

Frequently Asked Questions

How long does competitor link analysis take to complete?

Thorough competitor link analysis typically requires one to two weeks. The first week focuses on data gathering and organization. The second week covers quality evaluation and opportunity prioritization. Rushing the process produces incomplete insights.

What tools do I need for competitor backlink analysis?

You need at least one comprehensive backlink analysis platform like Ahrefs, Semrush, or Moz. These tools provide the data exports and comparison features essential for competitive analysis. Many professionals use multiple tools for cross-referencing.

How many competitor links can I realistically replicate?

Replication rates vary by link type and quality. Expect to successfully replicate 10-30% of identified opportunities. Resource page and directory links have higher success rates. Editorial links require more effort with lower conversion rates.

Should I try to replicate all competitor links?

No. Many competitor links are low-quality, irrelevant, or acquired through methods you should not replicate. Evaluate each opportunity independently. Focus on high-quality, relevant links that align with your brand and content.

How often should I conduct competitor link analysis?

Conduct comprehensive analysis during initial strategy development and when launching new products or targeting new keywords. Perform lighter quarterly monitoring to catch competitive changes and new opportunities.

Can competitor link analysis hurt my SEO?

Analysis itself causes no harm. However, replicating low-quality or spammy competitor links can damage your rankings. Always evaluate link quality independently rather than assuming competitor links are safe to replicate.

What is the difference between link gap analysis and competitor link analysis?

Competitor link analysis examines competitor backlink profiles comprehensively. Link gap analysis specifically identifies sites linking to competitors but not to you. Gap analysis is one component of broader competitor link analysis.