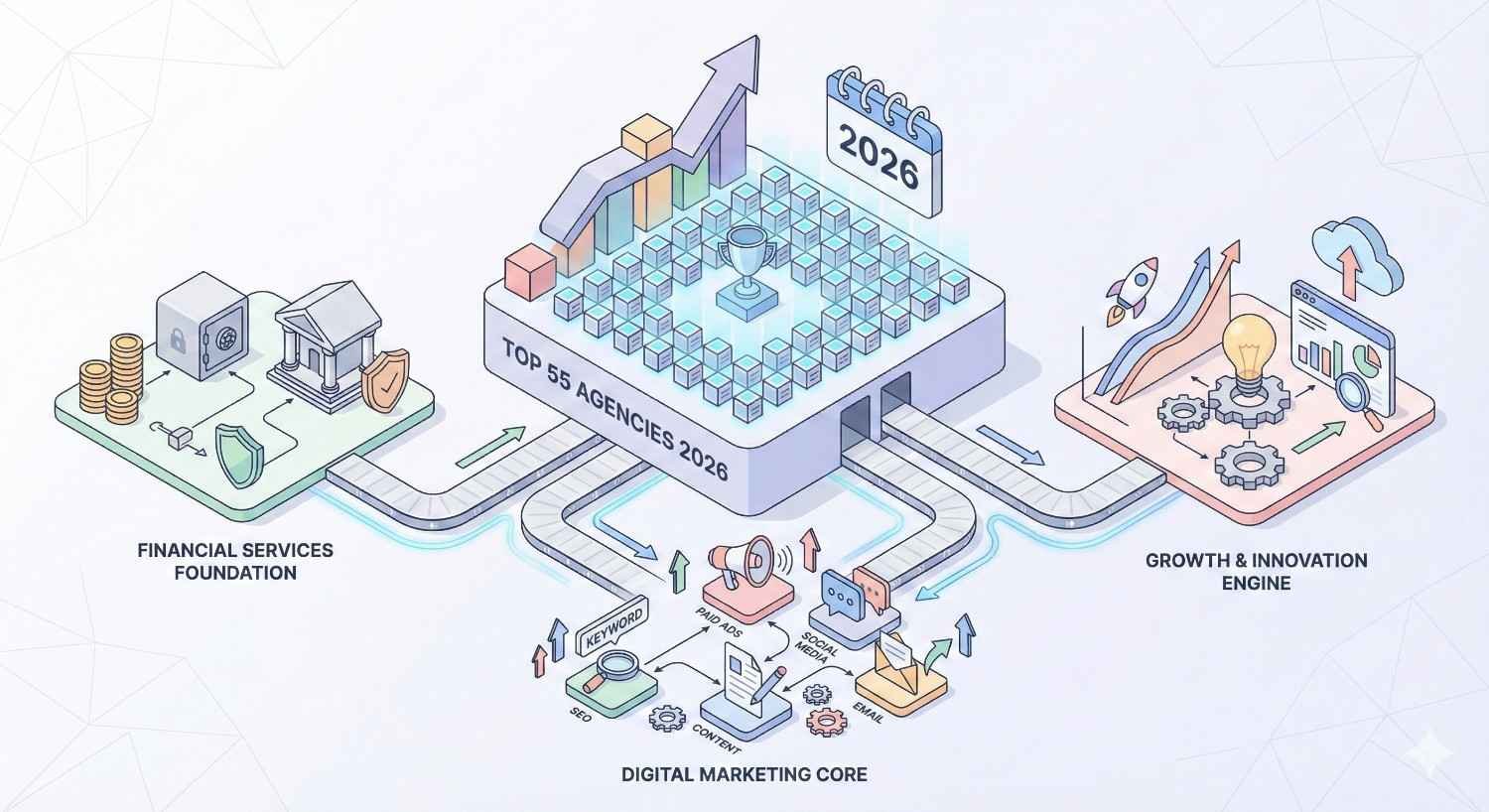

Choosing the right digital marketing agency for financial services can mean the difference between stagnant growth and a pipeline filled with qualified leads. This guide ranks the top 55 financial services digital marketing agencies in 2026, evaluated across expertise, compliance knowledge, client results, and industry specialization.

Financial institutions face unique marketing challenges. Strict regulations, complex products, and high-trust requirements demand agencies that understand both digital strategy and the nuances of finance. Whether you manage a regional credit union, a global investment firm, or a fast-scaling fintech, the agencies on this list have proven track records in your space.

You will learn how we ranked these agencies, explore detailed profiles of each one, and discover which specialists excel in your specific niche. We also cover selection criteria, pricing models, and the trends shaping financial marketing in 2026.

What Is a Financial Services Digital Marketing Agency?

A financial services digital marketing agency is a specialized firm that helps banks, credit unions, insurance companies, wealth management firms, fintechs, and other financial institutions attract, engage, and convert customers through digital channels. These agencies combine traditional digital marketing expertise with deep knowledge of financial regulations, compliance requirements, and the unique buyer journeys in financial services.

Unlike generalist marketing agencies, financial services specialists understand the constraints of advertising financial products. They know how to create compelling campaigns that pass legal review, build trust with skeptical consumers, and generate measurable returns in a highly competitive landscape.

Core Services Offered

Financial services digital marketing agencies typically provide a comprehensive suite of services tailored to the industry’s specific needs.

Search Engine Optimization (SEO) forms the foundation for most agencies. This includes technical SEO audits, content strategy development, local SEO for branch-based institutions, and authority building through compliant link acquisition. Financial keywords are among the most competitive online, requiring sophisticated strategies to rank.

Pay-Per-Click Advertising (PPC) encompasses Google Ads, Microsoft Advertising, and programmatic display campaigns. Agencies manage bidding strategies, ad copy that meets regulatory requirements, landing page optimization, and conversion tracking across complex attribution models.

Content Marketing involves creating educational resources, blog posts, whitepapers, calculators, and interactive tools that attract prospects at various stages of the financial decision-making process. Content must balance SEO requirements with compliance review processes.

Social Media Marketing covers organic content strategy, paid social campaigns, community management, and reputation monitoring across platforms where financial consumers research and engage. LinkedIn dominates B2B financial marketing, while Facebook and Instagram drive consumer financial products.

Email Marketing and Marketing Automation includes lead nurturing sequences, customer onboarding campaigns, cross-sell programs, and retention communications. Agencies build segmentation strategies and automation workflows that comply with CAN-SPAM, GDPR, and financial privacy regulations.

Conversion Rate Optimization (CRO) focuses on improving application completion rates, reducing form abandonment, and optimizing the digital customer journey from first touch to account opening or policy purchase.

Analytics and Reporting provides dashboards, attribution modeling, and ROI analysis that connect marketing activities to business outcomes like cost per acquisition, customer lifetime value, and assets under management growth.

Why Financial Services Require Specialized Marketing

Financial services marketing operates under constraints that most industries never encounter. Understanding these challenges explains why specialized agencies deliver better results than generalists.

Regulatory Compliance represents the most significant differentiator. Financial advertising must comply with regulations from bodies including the SEC, FINRA, FTC, CFPB, state insurance commissioners, and international equivalents. A single non-compliant ad can result in fines, enforcement actions, and reputational damage. Specialized agencies build compliance review into their workflows and understand what claims require disclaimers, what language triggers regulatory scrutiny, and how to create compelling marketing within these boundaries.

High-Stakes Purchase Decisions characterize financial products. Consumers researching mortgages, retirement accounts, or insurance policies conduct extensive research and require substantial trust before converting. Marketing must address objections, provide education, and build credibility over extended consideration periods that can span months.

Complex Products require marketing that simplifies without misleading. Explaining variable annuities, adjustable-rate mortgages, or cyber insurance coverage demands copywriters who understand the products and can communicate benefits clearly while meeting disclosure requirements.

Competitive Intensity in financial services means that generic marketing approaches fail. Major banks, insurance carriers, and fintechs invest heavily in digital marketing. Smaller institutions need agencies that can identify defensible niches and execute strategies that compete effectively against larger budgets.

Data Security and Privacy concerns require agencies that understand handling sensitive financial information, implementing proper tracking while respecting privacy regulations, and maintaining security standards expected by financial institutions.

How We Ranked the Top Financial Services Digital Marketing Agencies

Creating a definitive ranking of financial services digital marketing agencies requires a rigorous, transparent methodology. Our evaluation process combines quantitative metrics with qualitative assessments to identify agencies that consistently deliver results for financial clients.

Evaluation Criteria and Methodology

We assessed agencies across eight primary criteria, each weighted according to its importance for financial services clients.

Financial Services Experience (25% weight) measures the depth and breadth of an agency’s work with financial institutions. We evaluated years of experience in the sector, number of financial clients served, diversity of financial subsectors covered, and demonstrated understanding of industry-specific challenges.

Client Results and Case Studies (20% weight) examines documented outcomes from financial services engagements. We reviewed published case studies, verified performance claims where possible, and assessed the quality of metrics reported. Agencies that demonstrate clear ROI, lead generation improvements, or organic traffic growth for financial clients scored higher.

Compliance Expertise (15% weight) evaluates an agency’s understanding of financial marketing regulations. We assessed whether agencies have dedicated compliance resources, documented compliance review processes, and experience navigating regulatory requirements across different financial subsectors.

Service Breadth and Depth (15% weight) considers the comprehensiveness of services offered and the sophistication of execution. Full-service agencies that excel across SEO, PPC, content, and analytics scored higher than specialists, though depth in core services also factored into scoring.

Team Expertise (10% weight) examines the qualifications, certifications, and experience of agency leadership and staff. We considered industry certifications, speaking engagements, published thought leadership, and professional backgrounds.

Client Retention and Satisfaction (5% weight) uses available information about client relationships, including tenure of major accounts, testimonials, and third-party reviews on platforms like Clutch and G2.

Innovation and Technology (5% weight) assesses adoption of emerging technologies, proprietary tools, and forward-thinking approaches to financial marketing challenges.

Geographic Reach and Scalability (5% weight) evaluates an agency’s ability to serve clients across regions and scale services as client needs grow.

Data Sources and Verification Process

Our research drew from multiple data sources to build comprehensive agency profiles.

Primary Research included direct outreach to agencies for information about services, client lists, and case studies. We conducted interviews with agency leadership where possible and gathered information from agency websites, portfolios, and marketing materials.

Third-Party Platforms provided independent validation. We reviewed agency profiles and ratings on Clutch, G2, UpCity, and similar platforms. We examined client reviews, verified client lists, and assessed consistency between agency claims and third-party information.

Industry Recognition factored into our assessment. We tracked awards from organizations like the Financial Communications Society, ANA, and industry-specific publications. Conference speaking engagements and published research also contributed to expertise validation.

Client Verification involved confirming major client relationships through public information, case studies, and where possible, direct confirmation. We prioritized agencies with verifiable client relationships over those with unsubstantiated claims.

Competitive Analysis examined how agencies position themselves, their thought leadership content, and their visibility within the financial marketing ecosystem.

Scoring Framework

Each agency received a score from 0-100 based on weighted criteria performance.

90-100 (Exceptional): Industry leaders with extensive financial services experience, documented results, strong compliance capabilities, and comprehensive service offerings. These agencies set standards for the industry.

80-89 (Excellent): Strong performers with significant financial services expertise, good case studies, and reliable execution across core services. Minor gaps in certain areas prevent top-tier ranking.

70-79 (Very Good): Solid agencies with meaningful financial services experience and demonstrated capabilities. May excel in specific niches or services while having less depth in others.

60-69 (Good): Competent agencies with relevant experience and acceptable performance. Suitable for specific use cases but may lack the depth or breadth of higher-ranked competitors.

Agencies scoring below 60 were not included in our top 55 ranking.

Top 55 Financial Services Digital Marketing Agencies in 2026

The following agencies represent the best options for financial institutions seeking digital marketing partners. Each profile includes an overview, core specialties, and notable clients where publicly available.

Top 10 Global Leaders (#1-#10)

These agencies have established themselves as the premier choices for financial services digital marketing, combining deep expertise, proven results, and comprehensive capabilities.

#1 Wpromote

Overview: Wpromote has built one of the most respected financial services practices in digital marketing. The agency combines data-driven strategy with creative execution, serving clients ranging from regional banks to global financial institutions. Their integrated approach spans paid media, SEO, content, and analytics with dedicated financial services teams.

Specialties: Performance marketing, paid search and social, SEO, content marketing, analytics and attribution, conversion optimization

Notable Clients: Zenith Bank, Transamerica, Frontier Airlines Credit Union, various Fortune 500 financial institutions

Why They Rank #1: Wpromote’s combination of scale, financial services expertise, and documented results places them at the top. Their proprietary technology platform and dedicated compliance workflows address the unique needs of financial marketers.

#2 Power Digital Marketing

Overview: Power Digital has emerged as a leader in growth marketing for financial services, with particular strength in fintech and digital-first financial brands. Their performance-focused approach emphasizes measurable outcomes and rapid optimization.

Specialties: Growth marketing, paid acquisition, SEO, influencer marketing, creative services, marketing intelligence

Notable Clients: Multiple fintech unicorns, digital banks, payment processors, and insurance technology companies

Why They Rank #2: Power Digital’s fintech expertise and growth marketing methodology deliver exceptional results for companies prioritizing rapid customer acquisition and scalable marketing systems.

#3 Silverback Strategies

Overview: Silverback Strategies has developed deep expertise in financial services through long-term relationships with banks, credit unions, and wealth management firms. Their strategic approach emphasizes sustainable growth over quick wins.

Specialties: SEO, paid media, content strategy, analytics, conversion optimization, local search for branch networks

Notable Clients: Regional and national banks, credit unions, wealth management firms, insurance companies

Why They Rank #3: Silverback’s methodical approach to financial services marketing and strong track record with traditional financial institutions earns their top-three position.

#4 Metric Theory (Jellyfish)

Overview: Now part of Jellyfish, Metric Theory brings sophisticated paid media capabilities to financial services clients. Their data science approach to campaign optimization delivers strong performance across complex financial product categories.

Specialties: Paid search, paid social, programmatic display, Amazon advertising, analytics, creative optimization

Notable Clients: Lending platforms, insurance carriers, investment platforms, banking institutions

Why They Rank #4: Metric Theory’s analytical rigor and paid media expertise make them a top choice for financial services companies with significant advertising budgets.

#5 Directive Consulting

Overview: Directive specializes in B2B and SaaS marketing, with a growing financial services practice serving fintech companies, B2B financial platforms, and enterprise financial technology providers. Their customer generation methodology focuses on pipeline and revenue outcomes.

Specialties: B2B paid media, SEO, content marketing, conversion optimization, revenue operations integration

Notable Clients: B2B fintech companies, financial software providers, enterprise financial platforms

Why They Rank #5: Directive’s B2B expertise translates exceptionally well to financial services companies selling to businesses, advisors, or institutions.

#6 Tinuiti

Overview: Tinuiti operates as one of the largest independent performance marketing agencies, with substantial financial services experience across banking, insurance, and fintech verticals. Their scale enables sophisticated testing and optimization capabilities.

Specialties: Paid search, paid social, programmatic, Amazon, affiliate marketing, analytics, creative services

Notable Clients: Major insurance carriers, national banks, fintech platforms, credit card issuers

Why They Rank #6: Tinuiti’s scale and performance marketing focus deliver results for financial services companies with substantial digital advertising investments.

#7 Nebo Agency

Overview: Nebo combines strategic thinking with creative excellence, serving financial services clients who need both performance and brand building. Their integrated approach spans paid, earned, and owned media.

Specialties: Paid media, SEO, content marketing, creative services, social media, analytics

Notable Clients: Regional banks, credit unions, insurance agencies, wealth management firms

Why They Rank #7: Nebo’s balance of strategy, creativity, and performance makes them ideal for financial institutions seeking comprehensive marketing partnerships.

#8 Ignite Visibility

Overview: Ignite Visibility has built a strong reputation in financial services SEO and paid media, with particular expertise in competitive keyword categories. Their proprietary forecasting methodology helps clients understand expected outcomes.

Specialties: SEO, paid media, social media marketing, email marketing, conversion optimization, Amazon marketing

Notable Clients: Lending companies, insurance providers, financial advisors, banking institutions

Why They Rank #8: Ignite Visibility’s SEO expertise and transparent approach to performance forecasting resonate with financial services clients seeking predictable results.

#9 Major Tom

Overview: Major Tom serves as a full-service agency with dedicated financial services capabilities spanning strategy, creative, and performance marketing. Their integrated team structure enables cohesive campaign execution.

Specialties: Strategy, branding, web development, SEO, paid media, content marketing, social media

Notable Clients: Banks, credit unions, insurance companies, investment firms across North America

Why They Rank #9: Major Tom’s full-service capabilities and financial services experience make them suitable for institutions seeking a single agency partner.

#10 WebFX

Overview: WebFX combines scale with specialization, offering dedicated financial services teams within a large agency structure. Their proprietary technology platform provides transparency and performance tracking.

Specialties: SEO, PPC, social media, content marketing, web design, marketing automation

Notable Clients: Banks, credit unions, financial advisors, insurance agencies, lending companies

Why They Rank #10: WebFX’s combination of financial services expertise, technology platform, and competitive pricing earns their top-ten position.

Enterprise-Level Agencies (#11-#25)

These agencies excel at serving large financial institutions with complex needs, substantial budgets, and sophisticated marketing requirements.

#11 Merkle (Dentsu)

Overview: Merkle brings enterprise-scale data and technology capabilities to financial services marketing. As part of Dentsu, they offer global reach with deep specialization in customer experience and performance marketing.

Specialties: Data-driven marketing, CRM, loyalty programs, performance media, analytics, customer experience

Notable Clients: Global banks, insurance carriers, credit card companies, investment firms

#12 VMLY&R

Overview: VMLY&R combines brand building with customer experience design for major financial services clients. Their creative capabilities complement strong digital performance.

Specialties: Brand strategy, creative, customer experience, digital transformation, performance marketing

Notable Clients: Major banks, insurance companies, financial technology providers

#13 R/GA

Overview: R/GA focuses on digital transformation and innovation for financial services clients, helping institutions modernize their marketing and customer experience approaches.

Specialties: Digital transformation, product design, brand building, marketing technology, venture partnerships

Notable Clients: Global financial institutions, fintech companies, payment networks

#14 Razorfish

Overview: Razorfish delivers digital experience and marketing solutions for enterprise financial services clients, with strength in technology implementation and customer journey optimization.

Specialties: Experience design, technology implementation, performance marketing, data and analytics

Notable Clients: Banks, insurance carriers, wealth management firms, payment companies

#15 iProspect (Dentsu)

Overview: iProspect specializes in performance marketing at enterprise scale, with dedicated financial services teams serving major institutions globally.

Specialties: Paid search, paid social, programmatic, SEO, affiliate marketing, commerce

Notable Clients: Global banks, insurance companies, credit card issuers, investment platforms

#16 Digitas

Overview: Digitas combines data, technology, and creativity for financial services clients seeking integrated marketing solutions at scale.

Specialties: Data strategy, creative, media, technology, customer experience, content

Notable Clients: Major financial institutions, insurance carriers, fintech companies

#17 360i

Overview: 360i delivers search, social, and creative solutions for financial services brands, with particular strength in content and social media marketing.

Specialties: Search marketing, social media, creative, content, analytics, influencer marketing

Notable Clients: Banks, insurance companies, financial technology providers

#18 Performics

Overview: Performics focuses on performance marketing outcomes for financial services clients, with sophisticated approach to attribution and optimization.

Specialties: Paid search, paid social, SEO, affiliate, programmatic, analytics

Notable Clients: Insurance carriers, banks, lending companies, financial services providers

#19 PMG

Overview: PMG combines media, creative, and technology for financial services clients, with proprietary technology platform enabling advanced optimization.

Specialties: Paid media, creative, technology, analytics, strategy

Notable Clients: Financial services companies, fintech brands, insurance providers

#20 Croud

Overview: Croud operates a distributed agency model with financial services expertise across global markets, offering flexibility and specialized talent.

Specialties: Paid media, SEO, content, analytics, creative, international marketing

Notable Clients: Global financial institutions, fintech companies, insurance carriers

#21 Brainlabs

Overview: Brainlabs brings a test-and-learn methodology to financial services marketing, with strong capabilities in paid media and analytics.

Specialties: Paid search, paid social, programmatic, SEO, analytics, experimentation

Notable Clients: Banks, fintech companies, insurance providers, lending platforms

#22 Goodway Group

Overview: Goodway Group specializes in programmatic and digital media for financial services, with sophisticated audience targeting capabilities.

Specialties: Programmatic media, paid social, connected TV, analytics, audience development

Notable Clients: Insurance companies, banks, financial advisors, lending companies

#23 Mediasmith

Overview: Mediasmith delivers media planning and buying for financial services clients, with expertise in complex regulatory environments.

Specialties: Media planning, media buying, programmatic, analytics, strategy

Notable Clients: Banks, credit unions, insurance companies, investment firms

#24 Amsive Digital

Overview: Amsive Digital combines data, media, and creative for financial services marketing, with strength in customer acquisition and retention.

Specialties: Data services, digital media, creative, direct mail, analytics

Notable Clients: Financial services companies, insurance carriers, banks

#25 Kepler Group

Overview: Kepler Group focuses on data-driven marketing for financial services, with sophisticated measurement and optimization capabilities.

Specialties: Media planning, data strategy, analytics, measurement, creative

Notable Clients: Financial institutions, insurance companies, fintech providers

Mid-Market Specialists (#26-#40)

These agencies serve mid-sized financial institutions with specialized expertise and personalized service levels.

#26 CSTMR

Overview: CSTMR specializes exclusively in fintech and financial services marketing, with deep expertise in the unique challenges of financial brand building and customer acquisition.

Specialties: Brand strategy, digital marketing, content, design, fintech expertise

Notable Clients: Fintech startups, digital banks, payment companies, lending platforms

#27 BankBound

Overview: BankBound focuses exclusively on banks and credit unions, with specialized knowledge of community financial institution marketing needs.

Specialties: Website design, SEO, digital advertising, content marketing, social media

Notable Clients: Community banks, credit unions, regional financial institutions

#28 FI GROW Solutions

Overview: FI GROW Solutions serves credit unions and community banks with inbound marketing and growth strategies tailored to financial institution needs.

Specialties: Inbound marketing, content strategy, SEO, marketing automation, website development

Notable Clients: Credit unions, community banks, financial cooperatives

#29 Kasasa

Overview: Kasasa provides marketing services alongside their financial products, offering integrated solutions for community financial institutions.

Specialties: Product marketing, digital advertising, content, creative services, analytics

Notable Clients: Community banks, credit unions using Kasasa products

#30 EVERFI (Blackbaud)

Overview: EVERFI combines financial education content with marketing capabilities, helping financial institutions build community relationships and generate leads.

Specialties: Financial education, content marketing, community engagement, lead generation

Notable Clients: Banks, credit unions, insurance companies, financial advisors

#31 Mower

Overview: Mower serves financial services clients with integrated marketing communications, combining traditional and digital capabilities.

Specialties: Brand strategy, advertising, digital marketing, public relations, content

Notable Clients: Banks, insurance companies, financial services providers

#32 Pannos Marketing

Overview: Pannos Marketing specializes in financial services with particular strength in mortgage and lending marketing.

Specialties: Mortgage marketing, digital advertising, content, creative, compliance

Notable Clients: Mortgage lenders, banks, credit unions, loan officers

#33 Financial Marketing Solutions

Overview: Financial Marketing Solutions focuses on community banks and credit unions with comprehensive marketing services.

Specialties: Digital marketing, traditional advertising, direct mail, website development

Notable Clients: Community banks, credit unions, regional financial institutions

#34 Harland Clarke (Vericast)

Overview: Harland Clarke provides marketing services to financial institutions alongside their core business products, offering integrated solutions.

Specialties: Direct mail, digital marketing, data services, customer engagement

Notable Clients: Banks, credit unions, financial institutions of all sizes

#35 Deluxe

Overview: Deluxe offers marketing services for financial institutions as part of their broader business services portfolio.

Specialties: Website services, digital marketing, data-driven marketing, payments marketing

Notable Clients: Banks, credit unions, small business financial services

#36 James & Matthew

Overview: James & Matthew specializes in financial services creative and digital marketing with a focus on brand differentiation.

Specialties: Brand strategy, creative, digital marketing, content, video

Notable Clients: Banks, wealth management firms, insurance companies

#37 Watauga Group

Overview: Watauga Group serves financial services clients with media planning, buying, and digital marketing services.

Specialties: Media planning, media buying, digital marketing, analytics

Notable Clients: Insurance companies, banks, financial services providers

#38 Adrenaline

Overview: Adrenaline focuses on financial institution branding and customer experience, combining strategy with implementation.

Specialties: Brand strategy, retail design, digital experience, marketing communications

Notable Clients: Banks, credit unions, financial institutions

#39 Signal Theory

Overview: Signal Theory serves financial services clients with research-driven marketing strategies and creative execution.

Specialties: Research, strategy, creative, digital marketing, content

Notable Clients: Banks, insurance companies, agricultural finance

#40 Caliber Group

Overview: Caliber Group provides marketing services for financial institutions with emphasis on strategic planning and execution.

Specialties: Strategic planning, digital marketing, creative, public relations

Notable Clients: Banks, credit unions, financial services companies

Emerging & Boutique Agencies (#41-#55)

These agencies offer specialized expertise, innovative approaches, or niche focus areas that make them valuable options for specific financial services marketing needs.

#41 Fintech Growth Syndicate

Overview: Fintech Growth Syndicate focuses exclusively on fintech companies, offering growth marketing services tailored to venture-backed financial technology startups.

Specialties: Growth marketing, paid acquisition, SEO, content, conversion optimization

Notable Clients: Fintech startups, digital lending platforms, payment companies

#42 Clarity Quest Marketing

Overview: Clarity Quest serves financial services alongside healthcare, with expertise in regulated industry marketing.

Specialties: Digital marketing, content, SEO, paid media, marketing automation

Notable Clients: Financial advisors, insurance companies, fintech providers

#43 Bluetext

Overview: Bluetext combines brand building with digital marketing for financial services and technology clients.

Specialties: Brand strategy, website design, digital marketing, creative

Notable Clients: Fintech companies, financial technology providers, B2B financial services

#44 Responsory

Overview: Responsory specializes in direct response marketing for financial services, with expertise in customer acquisition.

Specialties: Direct response, digital marketing, creative, analytics, testing

Notable Clients: Insurance companies, financial services providers, lending companies

#45 Gate 39 Media

Overview: Gate 39 Media focuses on financial services and fintech marketing with emphasis on content and digital strategy.

Specialties: Content marketing, SEO, digital strategy, creative, website development

Notable Clients: Fintech companies, financial advisors, trading platforms

#46 Slice Communications

Overview: Slice Communications serves financial services clients with public relations and digital marketing integration.

Specialties: Public relations, content marketing, social media, digital marketing

Notable Clients: Financial services companies, fintech startups, insurance providers

#47 Provoke Insights

Overview: Provoke Insights combines market research with marketing strategy for financial services clients.

Specialties: Market research, brand strategy, customer insights, marketing strategy

Notable Clients: Banks, insurance companies, financial services providers

#48 Brandpoint

Overview: Brandpoint specializes in content marketing and distribution for financial services brands.

Specialties: Content creation, content distribution, native advertising, sponsored content

Notable Clients: Financial services companies, insurance providers, banks

#49 Imaginuity

Overview: Imaginuity serves financial services clients with integrated marketing combining data, media, and creative.

Specialties: Data strategy, media, creative, digital marketing, analytics

Notable Clients: Banks, insurance companies, financial advisors

#50 Raka

Overview: Raka focuses on inbound marketing and growth for financial services companies seeking sustainable lead generation.

Specialties: Inbound marketing, content, SEO, marketing automation, website development

Notable Clients: Financial advisors, insurance agencies, fintech companies

#51 Sagefrog Marketing Group

Overview: Sagefrog serves B2B financial services with integrated marketing services and strategic planning.

Specialties: B2B marketing, branding, digital marketing, content, lead generation

Notable Clients: B2B financial services, fintech companies, financial technology providers

#52 Kuno Creative

Overview: Kuno Creative delivers inbound marketing and sales enablement for financial services companies.

Specialties: Inbound marketing, content, sales enablement, marketing automation, video

Notable Clients: Financial services companies, fintech providers, B2B finance

#53 SmartBug Media

Overview: SmartBug Media specializes in inbound marketing with HubSpot expertise for financial services clients.

Specialties: Inbound marketing, HubSpot implementation, content, SEO, paid media

Notable Clients: Financial advisors, insurance companies, fintech startups

#54 New Breed

Overview: New Breed focuses on revenue operations and inbound marketing for B2B financial services companies.

Specialties: Revenue operations, inbound marketing, HubSpot, sales enablement

Notable Clients: B2B fintech, financial technology, financial services providers

#55 Beacon Digital Marketing

Overview: Beacon Digital Marketing serves B2B companies including financial services with demand generation expertise.

Specialties: Demand generation, content marketing, SEO, paid media, ABM

Notable Clients: B2B financial services, fintech companies, financial technology

Financial Services Digital Marketing Agencies by Specialty

Different financial subsectors have unique marketing requirements. The following categorization helps you identify agencies with specific expertise in your area.

Best for Banking & Credit Unions

Banks and credit unions require agencies that understand branch-based marketing, local SEO, deposit and loan product promotion, and community engagement strategies.

Top Recommendations:

- BankBound excels at community bank and credit union marketing with deep specialization

- FI GROW Solutions delivers inbound marketing tailored to credit union needs

- Silverback Strategies brings sophisticated SEO and paid media to banking clients

- Financial Marketing Solutions offers comprehensive services for community institutions

- WebFX provides scalable solutions for banks of various sizes

These agencies understand the regulatory environment for deposit products, the importance of local search visibility for branch networks, and the competitive dynamics of retail banking.

Best for Wealth Management & Investment Firms

Wealth management and investment marketing requires understanding of SEC and FINRA regulations, high-net-worth audience targeting, and trust-building content strategies.

Top Recommendations:

- Wpromote serves major wealth management firms with sophisticated campaigns

- Directive Consulting excels at B2B marketing for institutional investment services

- Gate 39 Media specializes in financial advisor and trading platform marketing

- Clarity Quest Marketing understands regulated industry marketing requirements

- SmartBug Media delivers inbound strategies for advisory firms

These agencies create compliant content that educates prospects, builds credibility, and generates qualified leads for advisory relationships.

Best for Insurance Companies

Insurance marketing spans property and casualty, life, health, and specialty lines, each with distinct regulatory requirements and customer journeys.

Top Recommendations:

- Tinuiti serves major insurance carriers with performance marketing at scale

- Goodway Group delivers sophisticated audience targeting for insurance products

- Responsory specializes in direct response insurance marketing

- Watauga Group provides media expertise for insurance advertisers

- Mower combines brand and direct response for insurance clients

These agencies navigate state-by-state regulatory variations, create compelling product comparisons, and optimize for long consideration cycles typical in insurance purchases.

Best for Fintech & Payment Solutions

Fintech companies require agencies that understand rapid growth expectations, venture-backed business models, and digital-first customer acquisition.

Top Recommendations:

- Power Digital Marketing leads in fintech growth marketing

- CSTMR specializes exclusively in fintech and financial services

- Fintech Growth Syndicate focuses on venture-backed fintech startups

- Directive Consulting excels at B2B fintech marketing

- Bluetext combines brand building with digital for fintech

These agencies understand product-led growth, viral mechanics, and the aggressive timelines typical of fintech marketing.

Best for Cryptocurrency & Blockchain

Cryptocurrency and blockchain companies face unique advertising restrictions and audience targeting challenges that require specialized expertise.

Top Recommendations:

- Power Digital Marketing has experience with crypto and blockchain clients

- CSTMR works with digital asset companies

- Gate 39 Media serves trading platforms including crypto

- Fintech Growth Syndicate includes blockchain in their fintech focus

These agencies navigate platform advertising restrictions, build organic visibility strategies, and understand the crypto-native audience.

Financial Services Digital Marketing Agencies by Region

Geographic presence can matter for financial services marketing, particularly for institutions with regional focus or those requiring in-person collaboration.

North America

The majority of top-ranked agencies maintain primary operations in North America, with concentrations in major financial centers.

New York Metro Area: Merkle, R/GA, Razorfish, 360i, Digitas Los Angeles/Southern California: Wpromote, Power Digital, Ignite Visibility Chicago: Performics, Croud (US operations) Boston: New Breed, various fintech specialists Washington DC Area: Silverback Strategies, Bluetext

Regional banks and credit unions often benefit from agencies with local market knowledge and ability to meet in person.

Europe & UK

Several agencies serve European financial institutions with understanding of GDPR, FCA regulations, and regional market dynamics.

London: Brainlabs, Croud, Jellyfish (Metric Theory parent) Continental Europe: Croud, Kepler Group, various Dentsu agencies

European financial marketing requires agencies familiar with cross-border regulations and multilingual campaign management.

Asia-Pacific

Global agencies with APAC presence serve financial institutions in major Asian markets.

Singapore: Various global agency offices Hong Kong: Major holding company agencies Australia: Regional offices of global agencies

APAC financial marketing requires understanding of diverse regulatory environments and cultural considerations.

Global/Multi-Region

Large financial institutions often require agencies capable of coordinating campaigns across multiple regions.

Best for Global Campaigns:

- Merkle (Dentsu) offers global coordination

- VMLY&R provides worldwide creative and media

- iProspect delivers global performance marketing

- Croud operates distributed model across regions

- Kepler Group serves multinational clients

These agencies manage currency, language, regulatory, and cultural variations across international campaigns.

Comparison Table: Top 55 Agencies at a Glance

| Rank | Agency | Primary Specialty | Best For | Pricing Tier |

| 1 | Wpromote | Full-service performance | Enterprise, mid-market | Premium |

| 2 | Power Digital | Growth marketing | Fintech, digital-first | Premium |

| 3 | Silverback Strategies | SEO, paid media | Banks, credit unions | Mid-range |

| 4 | Metric Theory (Jellyfish) | Paid media | Large advertisers | Premium |

| 5 | Directive Consulting | B2B marketing | B2B fintech | Premium |

| 6 | Tinuiti | Performance marketing | Enterprise | Premium |

| 7 | Nebo Agency | Integrated marketing | Mid-market | Mid-range |

| 8 | Ignite Visibility | SEO, paid media | Mid-market | Mid-range |

| 9 | Major Tom | Full-service | Mid-market | Mid-range |

| 10 | WebFX | SEO, digital marketing | SMB to mid-market | Value |

| 11-15 | Enterprise agencies | Various | Enterprise | Premium |

| 16-25 | Enterprise agencies | Various | Enterprise | Premium |

| 26-40 | Mid-market specialists | Various | Mid-market | Mid-range |

| 41-55 | Boutique/emerging | Niche focus | Specific needs | Varies |

How to Choose a Financial Services Digital Marketing Agency

Selecting the right agency requires systematic evaluation of your needs, agency capabilities, and potential fit.

Key Factors to Consider

Financial Services Experience should be your primary filter. Ask for case studies from companies similar to yours in size, subsector, and business model. An agency that excels with fintech startups may not be the right fit for a community bank.

Compliance Capabilities matter significantly in financial services. Understand how the agency handles regulatory review, what compliance resources they have, and how they stay current with regulatory changes.

Service Alignment requires matching your needs with agency strengths. If you need comprehensive SEO improvement, choose an agency with demonstrated SEO expertise. If paid media is your priority, select an agency with strong performance marketing credentials.

Team Structure affects your experience. Understand who will work on your account, their experience levels, and how the agency handles account management and communication.

Technology and Reporting capabilities should match your expectations. Review sample reports, understand their analytics approach, and evaluate their technology stack.

Cultural Fit influences long-term relationship success. Assess communication styles, responsiveness during the sales process, and alignment with your working preferences.

Questions to Ask Before Hiring

Experience Questions:

- How many financial services clients do you currently serve?

- What subsectors of financial services have you worked with?

- Can you share case studies from clients similar to our company?

- How do you stay current with financial marketing regulations?

Process Questions:

- How do you handle compliance review for creative and content?

- What is your onboarding process and timeline?

- How do you structure account teams and who will work on our account?

- What is your reporting cadence and what metrics do you track?

Results Questions:

- What results have you achieved for similar clients?

- How do you define and measure success?

- What is a realistic timeline for seeing results?

- How do you handle underperformance?

Business Questions:

- What is your pricing model and what is included?

- What is your contract structure and termination policy?

- How do you handle scope changes and additional requests?

- What tools and technology do you use?

Red Flags to Avoid

Guaranteed Rankings or Results should raise concerns. No agency can guarantee specific rankings or outcomes given the variables involved in digital marketing.

Lack of Financial Services Experience is problematic. Generalist agencies may underestimate compliance requirements and industry-specific challenges.

Unclear Pricing or Hidden Fees suggest potential problems. Reputable agencies provide clear pricing and scope documentation.

High Employee Turnover can indicate internal problems that will affect your account. Ask about team stability and tenure.

Poor Communication During Sales Process often predicts poor communication as a client. If they are slow to respond before you sign, expect worse after.

Unwillingness to Provide References suggests they may not have satisfied clients to reference.

Budget Considerations and Pricing Models

Financial services digital marketing agencies typically use several pricing models.

Retainer Model involves fixed monthly fees for defined scope of services. This provides predictability and works well for ongoing relationships. Expect retainers ranging from $5,000 to $50,000+ monthly depending on scope and agency tier.

Project-Based Pricing applies to defined deliverables like website redesigns, audits, or campaign launches. Projects range from $10,000 to $500,000+ based on complexity.

Performance-Based Pricing ties compensation to results, often combined with base retainer. This aligns incentives but requires careful metric definition.

Hourly Rates apply for consulting or overflow work, typically ranging from $150 to $400+ per hour depending on seniority and agency.

Percentage of Spend models charge based on media budget managed, typically 10-20% of ad spend for paid media management.

Budget allocation should reflect your priorities and growth stage. Early-stage companies might invest more heavily in customer acquisition, while established institutions may balance acquisition with retention and brand building.

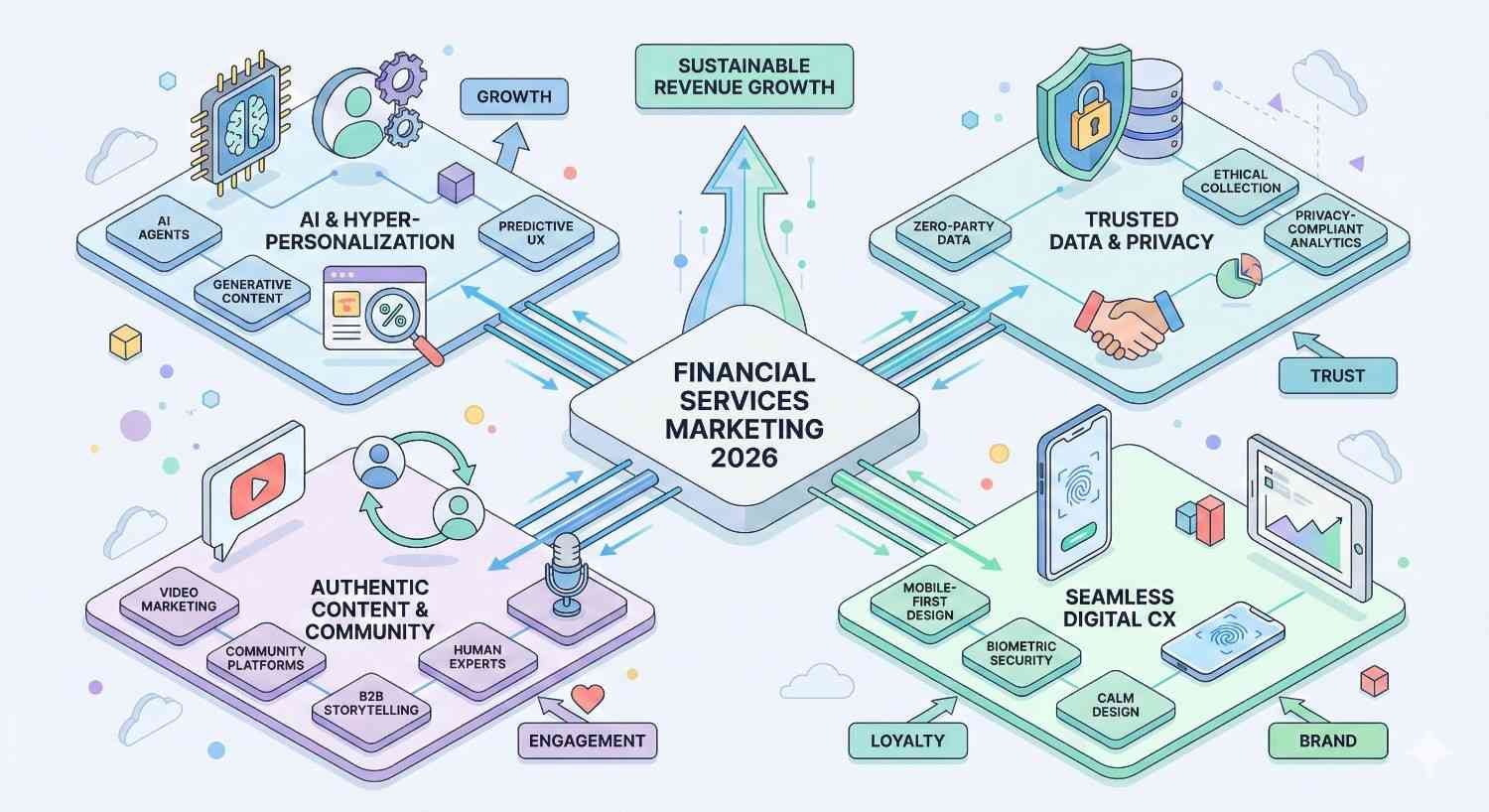

Digital Marketing Trends in Financial Services for 2026

Understanding current trends helps you evaluate agency capabilities and plan your marketing strategy.

AI and Automation in Financial Marketing

Artificial intelligence has transformed financial services marketing in several ways.

Personalization at Scale uses AI to deliver individualized content, offers, and experiences across channels. Leading agencies implement machine learning models that optimize messaging based on customer behavior and preferences.

Predictive Analytics enables better targeting and timing. AI models identify prospects most likely to convert, optimal contact timing, and product recommendations based on customer profiles.

Content Generation assists with creating variations for testing, personalizing communications, and scaling content production while maintaining compliance.

Chatbots and Conversational AI handle customer inquiries, qualify leads, and guide prospects through consideration processes.

Agencies leading in AI adoption include Merkle, Wpromote, and Tinuiti, with proprietary platforms incorporating machine learning capabilities.

Compliance and Regulatory Marketing Challenges

Regulatory complexity continues to increase, affecting marketing strategies.

Privacy Regulations including GDPR, CCPA, and emerging state laws require careful data handling and consent management. Agencies must implement compliant tracking and targeting approaches.

Advertising Restrictions on platforms like Google and Meta create challenges for financial product promotion. Agencies need expertise in navigating platform policies and finding compliant approaches.

Disclosure Requirements for financial products demand careful creative development and legal review processes.

State-by-State Variations in insurance and lending regulations require agencies to manage geographic targeting and messaging variations.

Top agencies have dedicated compliance resources and established review processes that balance regulatory requirements with marketing effectiveness.

Personalization and Customer Experience

Customer expectations for personalized experiences continue to rise.

Journey Orchestration coordinates messaging across channels based on customer behavior and lifecycle stage. Leading agencies implement sophisticated automation that delivers relevant content at each touchpoint.

Dynamic Content adapts website experiences, email content, and advertising based on visitor characteristics and behavior.

Account-Based Marketing for B2B financial services targets specific organizations with personalized campaigns.

Customer Data Platforms enable unified customer views that power personalization across channels.

Agencies with strong data and technology capabilities deliver superior personalization results.

Omnichannel Strategies

Financial services customers interact across multiple channels, requiring coordinated marketing approaches.

Channel Integration ensures consistent messaging and experience across digital and physical touchpoints.

Attribution Modeling tracks customer journeys across channels to understand marketing contribution and optimize spend.

Local-Digital Integration connects digital marketing with branch experiences for retail financial institutions.

Connected TV and Audio expand reach beyond traditional digital channels with measurable performance.

Agencies with omnichannel expertise help financial institutions create cohesive customer experiences.

Financial Services Digital Marketing Agency vs. In-House Team

Many financial institutions debate whether to use agencies, build internal teams, or combine both approaches.

Pros and Cons of Each Approach

Agency Advantages:

- Access to specialized expertise across disciplines

- Scalability to handle volume fluctuations

- External perspective and industry benchmarks

- Reduced management overhead

- Faster implementation of new capabilities

Agency Disadvantages:

- Less institutional knowledge of your business

- Potential communication challenges

- Ongoing costs that may exceed internal team

- Less control over priorities and resources

- Dependency on external partner

In-House Advantages:

- Deep understanding of business and products

- Direct control over priorities and execution

- Institutional knowledge retention

- Potentially lower long-term costs at scale

- Faster internal communication

In-House Disadvantages:

- Difficulty attracting and retaining specialized talent

- Limited perspective and benchmarking

- Fixed costs regardless of volume

- Slower to adopt new capabilities

- Management overhead and HR requirements

Hybrid Models

Most successful financial institutions use hybrid approaches combining internal and external resources.

Center of Excellence Model maintains internal strategy and coordination with agencies executing specific channels or campaigns.

Specialist Augmentation uses agencies for specialized capabilities like SEO or programmatic while handling other functions internally.

Overflow Model maintains core internal team with agency support for volume spikes or special projects.

Strategic Partnership treats agency as extension of internal team with deep integration and long-term relationship.

The optimal model depends on your organization’s size, capabilities, budget, and strategic priorities.

Conclusion: Finding Your Ideal Financial Services Marketing Partner

Selecting the right digital marketing agency can accelerate your financial institution’s growth, improve customer acquisition efficiency, and build sustainable competitive advantage. The 55 agencies profiled in this guide represent the best options available in 2026, each with distinct strengths suited to different needs.

Your selection process should prioritize financial services experience, compliance capabilities, and alignment with your specific goals. The agencies at the top of our ranking have demonstrated consistent results for financial clients, but the best choice for your organization depends on your size, subsector, budget, and strategic priorities.

At White Label SEO Service, we help financial institutions build sustainable organic growth through technical SEO, content strategy, and authority building. Whether you need a dedicated SEO partner or comprehensive digital marketing support, our team understands the unique requirements of financial services marketing. Contact us to discuss how we can support your growth objectives.

Frequently Asked Questions

What services do financial services digital marketing agencies offer?

Financial services digital marketing agencies typically provide SEO, paid search and social advertising, content marketing, email marketing, social media management, conversion optimization, and analytics. Most agencies offer integrated services, though some specialize in specific channels. The best agencies also provide compliance review and regulatory guidance specific to financial marketing.

How much do financial services marketing agencies charge?

Agency pricing varies significantly based on scope, agency tier, and service model. Monthly retainers typically range from $5,000 to $50,000+ for ongoing services. Project work ranges from $10,000 to $500,000+ depending on complexity. Paid media management often uses percentage-of-spend models at 10-20% of ad budget. Request detailed proposals from multiple agencies to compare pricing for your specific needs.

What makes financial services marketing different from other industries?

Financial services marketing faces unique challenges including strict regulatory compliance requirements, high-stakes purchase decisions with long consideration cycles, complex products requiring careful explanation, intense competition, and elevated trust requirements. Agencies must understand regulations from bodies like the SEC, FINRA, and state insurance commissioners while creating compelling marketing that passes legal review.

How long does it take to see results from a financial services marketing agency?

Timeline varies by channel and starting point. Paid advertising can generate leads within weeks of launch. SEO typically requires 4-8 months to show significant organic traffic improvements. Content marketing builds over 6-12 months as assets accumulate and gain authority. Set realistic expectations with your agency and establish milestone metrics for the first year.

Do agencies handle compliance and regulatory requirements?

Top financial services agencies have compliance expertise and review processes, but they do not replace your legal and compliance teams. Agencies should understand regulatory requirements, flag potential issues, and create marketing that minimizes compliance risk. However, final approval should come from your internal compliance function. Clarify compliance workflows and responsibilities before engaging any agency.

Should I choose a specialized financial services agency or a larger generalist agency?

The answer depends on your needs and budget. Specialized agencies offer deeper industry expertise and often better understand regulatory requirements. Larger agencies provide broader capabilities and may offer better rates for high-volume advertisers. Mid-sized financial institutions often benefit from specialized agencies, while enterprise organizations may need the scale of larger firms. Evaluate based on demonstrated financial services results rather than agency size alone.

How do I evaluate an agency’s financial services experience?

Request case studies from clients similar to your organization in size and subsector. Ask about specific team members who would work on your account and their financial services backgrounds. Inquire about compliance processes and regulatory expertise. Check references from current or recent financial services clients. Review their content and thought leadership for evidence of industry knowledge.